Bank Mergers

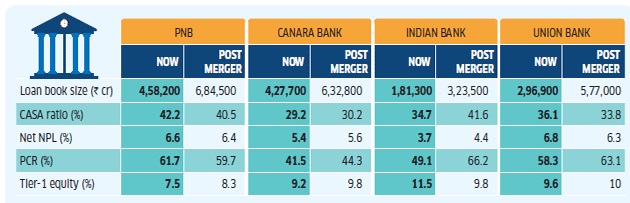

How does consolidation help?

Expert committees like Narsimhan Committee have recommended that India should have fewer but bigger and better managed banks to ensure.

1. Optimal use of capital

2. Efficiency of operations

3. Wider reach and greater profit

The rationale behind this is that all there banks complete for the same pie in narrow geographies, leading to each one incurring costs, it would sense to have large sized banks . The so called proposed big banks would be able to complete globally .

What’s there for government ?

To grow and lend more banks often need a higher amount of capital to set aside also for loans that could go bad. The burden of infusing capital rests on majority shareholder .By reducing no of banks to a manageable count the government must be hoping that demands for capital infusion will lower progressively with included efficiencies and more well capitalized banks.

Potential risks of merger

- Smooth integration of operations always poses a risk especially with resistance could come from staff and unions in the entities being merged

- Issues like cultural fit, redeployment of staff and fewer carrier opportunities for many in a merged entity.

- Disruption of services in near term as the merger process gets under way

- Could result in fewer options for customers, an easing of personal touch which many of midsize and smaller banks have.

- Possible creation of systematically important institutions or those too Big to fail.

RBI’s Role

Creation of large sized banks will mean RBI will have to improve its supervisory and mentoring processes to address increased risks

Can consolidation make a difference?

Governance of Banks has been a Major issue, merger alone won’t solve the problem alone.