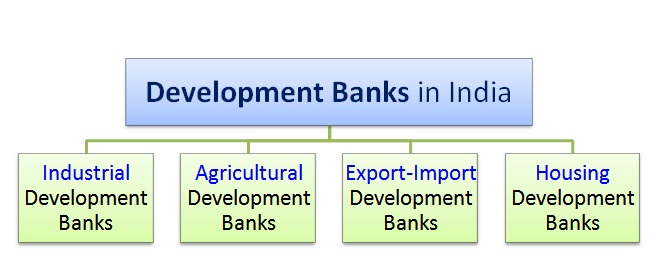

DEVELOPMENT BANKS

Development banks are financial institutions that provide long-term credit for capital-intensive investments spread over a long period and yielding low rates of return, such as urban infrastructure, mining and heavy industry. Such banks often lend at low and stable rates of interest to promote long-term investments with considerable social benefits. Development banks are also known as term-lending institutions or development finance institutions. To lend for long term, development banks require long-term sources of finance, usually obtained by issuing long-dated securities in capital market.During the Great Depression in the 1930s, Keynes argued that when business confidence is low on account of an uncertain future with low-interest rates, the government can set up a National Investment Bank to mop up the society’s savings and make it available for long-term development by the private sector and local governments.

Following foregoing precepts, IFCI, previously the Industrial Finance Corporation of India, was set up in 1949. This was probably India’s first development bank for financing industrial investments. In 1955, the World Bank prompted the Industrial Credit and Investment Corporation of India (ICICI) — the parent of the largest private commercial bank in India today, ICICI Bank. In 1964, IDBI was set up as an apex body of all development finance institutions.

As the domestic saving rate was low, and capital market was absent, development finance institutions were financed by

(i) lines of credit from the Reserve Bank of India

(ii) Statutory Liquidity Ratio bonds, into which commercial banks had to invest a proportion of their deposits.

However, development banks got discredited for mounting non-performing assets, allegedly caused by politically motivated lending and inadequate professionalism in assessing investment projects for economic, technical and financial viability. After 1991, following the Narasimham Committee reports on financial sector reforms, development finance institutions were disbanded and got converted to commercial banks. The result was a steep fall in long-term credit from a tenure of 10-15 years to five years. The development of the debt market has been an article of faith for over a quarter-century, but it has failed to take off. Taking this scenario into picture the Finance Minister’s agenda for setting up a development bank is welcome. One sincerely hopes that the political and administrative leadership carefully weigh in the past lessons.