SEBI?

Context:

The government’s proposal to transfer surplus money with the Securities and Exchange Board of India (SEBI) to the Consolidated Fund of India (CFI) has met with a strong opposition from the regulatory body.

The capital markets regulator SEBI feels that the proposal would result in compromising its “autonomy and its ability to function effectively” towards the progress and development of the Indian securities market.

About Securities and Exchange Board of India (SEBI):

The Securities and Exchange Board of India was established on April 12, 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

Since inception, SEBI is subjected to CAG audit, not a single instance of financial imprudence is observed.

The surplus of the SEBI money normally goes to General Fund of SEBI which is over of Rs.3,000 Cr. It is used to meet the expenses of a regulatory body including, salaries and allowances.

The fund gets money by the charges that SEBI levies on market participants in the form of registration or processing fees.

Recent Government Proposal:

The government has proposed an amendment to the SEBI Act, which states that the SEBI would constitute a reserve fund and 25% of the annual surplus of the general fund would be put in the reserve fund.

Further, the size of such reserve fund cannot exceed the total of annual expenditure of the preceding two financial years.

More importantly, the surplus of the general fund, after factoring in all the SEBI expenses and the transfer to the reserve fund, needs to be transferred to the CFI as per amendments proposed in the Finance Bill, 2019.

The proposed amendment (is being made) through a money bill as against the current provisions in the SEBI Act, which were well debated in Parliament and enacted thereafter.

Government’s argument for proposal:

Centre thinks that it can do a better job of regulating the economy by consolidating all existing power under the Finance Ministry. But, such centralisation of powers will be risky.

Regulatory agencies, such as SEBI needs to be given full powers over their assets. They should be made accountable to the Parliament.

If the powers are subsumed by the Centre, it will certainly effect their credibility.

Trimming SEBI’s financial independence is potentially regressive:

New amendments to the SEBI Act 1992 lurking in the latest Finance Bill, seek to make material changes to the way the market regulator meets its capital requirements.

They propose that SEBI obtain the approval of the Centre, in addition to that of its own Board, for all capital expenditure plans.

They also mandate that SEBI retain just 25 per cent of its annual surpluses in a Reserve Fund while ploughing the rest into the Consolidated Fund of India.

The Reserve Fund is also proposed to be capped at two year’s annual expenditure.

The intent seems to be to prevent SEBI from accumulating material reserves, or proceeding with major expenditure plans, without the Centre’s go-ahead. Predictably, this hasn’t gone down well with SEBI which is protesting that this would compromise its regulatory autonomy.

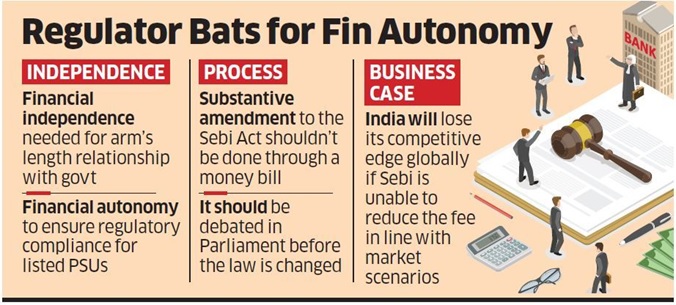

Any substantive amendment to the SEBI Act should be debated in the Parliament before the law is changed.

Present amendment introduced as a Money bill, it means that it only have to be approved by the lower house, in which the government has a clear majority.

It will lead to Compromise in Financial Autonomy:

The proposal will also impinge on the financial autonomy of SEBI as it will have to seek government approval for capital expenditure, which can range from setting up IT infrastructure, expanding the organisational capacity, or any other physical and soft infrastructure that SEBI may require in the light of continuously evolving global securities markets to increasing its employee strength.

SEBI’s Committee on Corporate Governance in its report submitted in 2017 highlighted the regulator’s staff shortage, comparing it with the US Securities and Exchange Commission (SEC).

The report mentioned that while the US regulator has around one employee for each listed company, its Indian counterpart had one for six listed companies.

Autonomy of a regulatory institution like SEBI is, therefore, critical as it insulates the institution from external compulsions and thus, provides long term continuity in its efforts towards achieving its objectives.

Conclusion:

Forcing SEBI to disgorge the bulk of its reserves would therefore materially dent its income, impairing its ability to invest in regulatory capacity-building.

In their letter to PMO, however, SEBI employees dubbed the proposal as “regressive in nature” and against the spirit of the SEBI Act, 1992.

Given the dated audited accounts that SEBI has put out in the public domain, the CAG is quite right to critique the opaque manner in which India’s financial regulators manage public money.

While demanding greater financial autonomy, regulators must also show themselves to be accountable to the public by being more transparent about their financial affairs.